top of page

Search

Monthly Market Insights

The Indian markets kicked off 2026 with a sharp but short-lived correction — Nifty 50 fell roughly 3% from its all-time highs in January, rattled by profit-booking and pre-budget jitters. But beneath the surface, the story remains encouraging. Domestic investor flows held steady, SIP contributions hit record highs, and the RBI signalled a more growth-friendly stance with a rate cut and significant liquidity support. For investors, the takeaway is clear: this isn't a crisis —

Ankur Kapur

4 min read

Gold & Silver: The Rush That Doesn’t Settle Down

Metals are not an area actively tracked in my research, but sharp moves in precious metals and investor questions warrant a closer look. This article addresses those questions for educational purposes only and should not be construed as investment advice. Consult your financial advisor for tailored guidance.

Ankur Kapur

3 min read

2025 in Retrospect, 2026 in Perspective: Navigating Opportunities in a Changing Market

If you've been tracking the markets as closely as most advisors do, 2025 stands out as something far more significant than just another profitable year on Dalal Street. It was the year that fundamentally rewrote the rules of India's equity market—the year when the baton passed from foreign to domestic hands.

Ankur Kapur

5 min read

Quarterly Equity Market Update: December 2025

Quarterly Equity Market Update: December 2025 Quarterly Equity Market Update Executive Summary As we enter the final month of 2025, Indian equity markets are navigating a complex phase of “growth vs. valuation.” While the domestic economy delivered a stunning 8.2% GDP growth in Q2 FY26, surpassing all estimates, equity benchmarks have faced selling pressure in November and early December. The Nifty 50, after reclaiming record highs in November, has recently corrected, weighe

Ankur Kapur

3 min read

Riding the Wave: What's Really Happening in India's Investment Markets Right Now

You know, there's this Buddhist idea that everything is constantly changing - nothing stays the same forever. It's funny how we barely notice the Earth spinning at 1,670 km/hour beneath our feet, yet we get anxious about daily market movements that are just as natural.

Ankur Kapur

3 min read

Where Can Your Money Grow? The Complete Guide to Investment Options in India

There are numerous options for investing and growing your money. The stock market, fixed deposits, and insurance policies are big favourites in India.

Ankur Kapur

2 min read

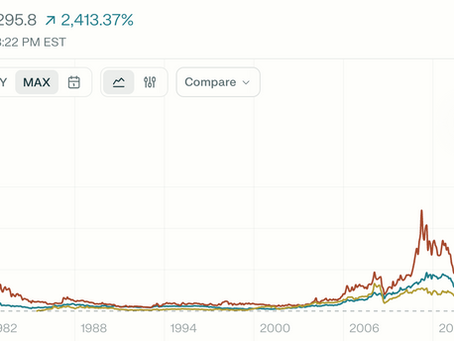

Understanding Investment Risk and Asset Diversification

There are four primary asset classes that most individuals can invest their money in:

1. Equity - This also refers to stocks traded in the stock market.

2. Debt refers to products like Fixed Deposits, Government bonds, the Public Provident Fund (PPF), and National Savings Certificates (NSCs).

3. Real Estate - Residential and commercial property or land.

4. Commodities - Stuff like Gold, Silver, etc.

Ankur Kapur

5 min read

Understanding & Leveraging Your Net Worth

One of the most critical steps in the financial planning process is to know your money, that is, your financial position, well, and then be able to manage it wisely.

Ankur Kapur

2 min read

What is inflation and why to invest?

There is a big difference between saving and investing. Saving is the process of putting cold, hard cash aside, usually in a savings...

Ankur Kapur

2 min read

Why are you saving money? Life..goals

Now that you have determined your income levels and have an idea of how much you are saving, it’s time to determine what you are saving...

Ankur Kapur

2 min read

_edited.png)

bottom of page